1. Investors used to think of gold as the safe haven in crisis. Now we see the gold price being down as the crisis continues. The oil price dropped but gold price hasn’t risen. Why? Will the gold price correlate to any other factors in the next couple of years?

1. Investors used to think of gold as the safe haven in crisis. Now we see the gold price being down as the crisis continues. The oil price dropped but gold price hasn’t risen. Why? Will the gold price correlate to any other factors in the next couple of years?

– Gold should not be viewed purely in the context of its immediate price performance, particularly as its primary benefit as an asset relates to its role in a portfolio and as a hedge against a variety of risks. Gold’s immediate price movements are often shaped by capital market sentiment and speculative trading, both of which are volatile but rarely define the longer term trends for gold.

Furthermore, gold’s safe haven role is far broader than it being a temporary solution in periods of crisis; how it responds to specific events or conditions will be shaped by the nature of the crisis.

We think it is more helpful to view gold as portfolio and wider market insurance.

Currently, large numbers of professional investors (particularly in the West) are still seeking out riskier assets and pursuing relatively short-term returns – our research suggests that an allocation to gold would balance this though for the most part, they are still very much under-invested in such ‘insurance’.

With regards to oil, gold is driven by a very different set of factors and, unlike oil, is far less influenced by global industrial consumption. Gold and oil are often mentioned in the same breath largely due to the fact that when inflation is expected to rise, both assets may also appreciate in value (although not necessarily for the same reasons).

Looking beyond current sentiment in London and New York, we see the outlook for gold being driven by the growth in consumers in the East and the ongoing modernisation of these markets. India and China are already the most substantial markets for gold and the outlook for both and their neighbouring markets are highly positive.

2. Do fundamentals such as gold supply influence the gold price? Could we say that gold price has stabilised because the producers maintain the lowest possible output levels to keep themselves afloat?

– The factors that shape gold’s value are complex and diverse – demand is driven by a uniquely wide range of factors, and supply includes both newly-mined gold and a substantial amount of recycled gold (between 25% and 30% of the annual total). Typically, it is the levels of gold sourced from re-refined supply, rather than mine production that falls in line with lower price expectations. Producers are constrained in their ability to respond to the price and, currently, production levels remain historically high. However, looking beyond this year and next, the moves to substantially reduce costs, the very limited sources of available funding and the lack of new promising exploration all suggest production levels are likely to fall in the near future, raising the prospect of constrained supply, which will then be supportive of the price.

3. When Glencore announced the plan to shut down its DRC mines, the copper price rose although the copper output at Glencore’s DRC mines was a mere 2% of world production. Is gold shortage possible due to the declining gold price and mine closure?

– The short term capital market response to such action – e.g. specific mine closures – is not necessarily indicative of the longer-term trends or outlook for a market. This is particularly the case with gold, which, unlike copper and most other commodities, is not ‘consumed’ as an industrial input, therefore the supply dynamics are more complex.

In terms of outlook, production is currently very high compared to its historical average, but this is largely due to projects initiated many years ago; substantial new deposits are now extremely hard (and expensive) to find and develop.

Although gold miners have acknowledged they have recently had to adapt to a challenging environment, over the longer term we are confident that growing demand from a very diverse range of sources means there will remain a very healthy level of demand for their product.

4. What do you think about the reinstatement of the gold standard? Could any one country make this decision alone or it should be an international decision?

– Since the initial conception and implementation of the classical gold standard and the post-war exchange standard, both the gold market and the international currency markets have considerably evolved. As a result, implementation of the gold standard, as previously defined, is simply probably not practical in today’s multi-currency world with far greater distribution of global gold ownership.

However, we do believe many countries will seek to adapt their reserve management strategies to move away from the dominance of the US dollar and gold will have a very significant role to play as these strategies evolve.

5. If such a decision were to be made, what sort of consequences should we expect in the short- and long-term?

– As stated earlier, we think these considerations – issues of national currency and reserve asset management – are more likely to be shaped by the moves towards more diverse, multi-polar strategies and gold is likely to play an increasingly prominent role as this trend develops. This is one of the reasons why central banks, particularly in developing nations, are now regular buyers of gold.

6. What was the purpose of your visit to Moscow?

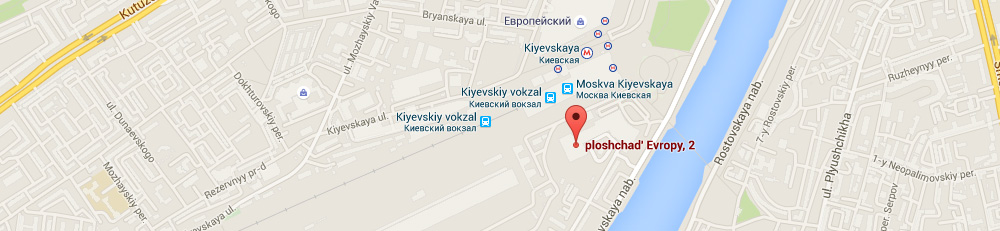

– The World Gold Council’s mandate is to stimulate and sustain the global demand for gold so we are always looking at how markets might be developed or enhanced. To undertake this work we need to understand the whole gold supply chain in particular countries and develop relationships and share views with key market participants. Russia is not only the third largest gold producer in the world, with substantial growth in production over the last decade, but also ranks third in terms of gold resources. We were therefore eager to start building better relationships with gold market participants in Russia and MINEX, as the most significant mining event in the country and host to a range of key decision makers, proved a very good venue for this.

7. Is it possible that Russian gold producers join the World Gold Council? If so, when it could happen?

– As the leading global market development organisation for the gold industry, it is important for us to develop and maintain strong relationships along the whole supply chain. We recognise the very important role Russia and Russian gold mining companies play in the international gold market. And we are certainly very open to discussing membership and closer collaboration with gold miners in Russia who share our vision of how to sustain and develop a vibrant gold global market.

Download Forum Brochure

Download Forum Brochure

Download Events Flyer

Download Events Flyer