October, 15

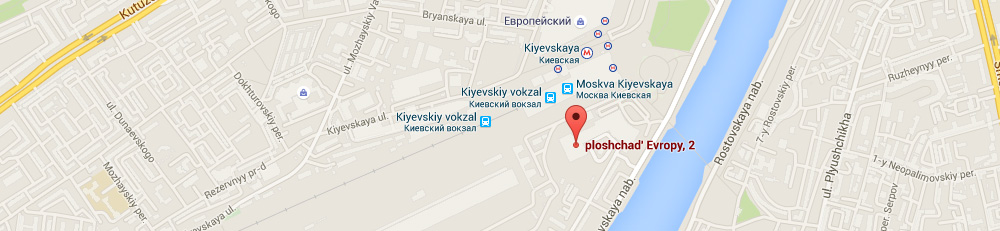

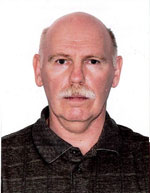

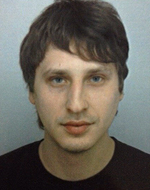

MINEX Russia 2015 spoke with Robin Young, Chief Executive Officer of Amur Minerals Corp. on the subject of how junior mining companies can attract funding for exploration projects in a difficult financial period of low commodity prices.

– S&P anticipates and moderates surplus of nickel production in next year and 2017. So the nickel price will probably not rise from current levels but will fall, it means your project can be unprofitable. What are your comments?

– S&P anticipates and moderates surplus of nickel production in next year and 2017. So the nickel price will probably not rise from current levels but will fall, it means your project can be unprofitable. What are your comments?

– You have to look towards the future. Today’s nickel price is $4.50/ lb or $10,000/ ton and going forward to the long term the nickel price is projected to be approximately $9-$10/lb or about $20,000/ton. We’re an exploration company and as such we have to move forward through a set of very specific tasks, which include engineering and design work. To accomplish this, we have to spend that money anyway. These activities are not affected by the nickel price because we have not made the final decision of construction. As we engineer our way through the process, time will pass over the next two years and at which point in time the nickel prices are projected to have recovered to as much as $12/lb, these pricings are based on the Royal Bank of Canada’s Securities Division.

So when you’re looking at an exploration project in this stage of development you have to look at the long term pricing principle, so yes today’s price is low and the major impact of today’s price is that 70 to 80% of the mining companies producing nickel today are actually losing money at their operations. You could well see a series of these companies shutting down their operations, moth balling and possibly even going out of business.

– According to the PFS the initial capital expenditure of the project is about $330 million. Where do you plan to find it from- stock markets, private equity funds, Russian government, programs or somewhere else? What do you think concerning the deeper participation of Chinese mining in Russian mining projects also.

– The actual capital cost is projected to be about $1.4 billion, it’s a tremendous expansion over the $330 million that you referred to previously which was the 2007 pre-feasibility study that we had done. We have re-estimated those costs and we are now at $1.4 billion as the maximum that we anticipate. The reason for the increase in the capital costs is that the operation is much larger than we thought it would be in 2007. We’re going to mine 2-3 times more tonnage per year, which results in a doubling of mobile mine fleet costs, capital costs associated with the plant, the design, the dormitories, fuel storage etc. This also includes the potential of adding a $650 million smelter, of which we probably only need to construct the first third of it, which is about a $125 million expenditure. By constructing the smelter furnace, it will allow us to produce a low grade matte for sale into the markets.

Now the sourcing of this money will come on the back of the work that we are doing today and in the near future. We have been and remain in contact with various international banks and organizations that fund long term construction projects. These banks would include the likes of Standard Bank, Society General, BNP Paribas. They provide long facilities and we have been in contact with them over the years and will continue to maintain the information flow between our company and the financial institutions.

As for moving on to China, that’s an area which has good funding potential and we have past contacts with them as well, so it’s not a new concept that we pursue potential Chinese investment and at this point in time we are focusing our efforts primarily in Russia. This is a natural consideration as we have a Russian project and as a Russian asset we intend to stay as Russian as possible.

– Robin, how does your company plan to solve the infrastructure problems for example; electricity supplies and road construction, have you made any decisions for this?

– Yes, basic primary decisions have been made at this time. The project design includes construction of a road to the site and a power line to the selected smelter site to be located along the BAM railroad. Both are key items and have been included in our infrastructure budget. What we are also doing at this point in time is working with the Far East Development Fund who’s key objectives are to work together to develop the planned design for Kun-Manie. There is an opportunity that in the future that we may be able to participate with the Russian government. But this is not cast nor have we assumed that this will be the case. For this very reason, our plan takes the most conservative route. This means we are intending to go it alone and that we will have to find this funding. Presently, we are advancing the project quite well and we’re pleased with our progress.

– What is the distance between the mine and the railway station, and what is the cost of this project also?

– The road itself is around 320km long and you can roughly estimate the construction of a level 4 Russian style road to be around $1 million / km. At this point in time we may be able to cut that estimated cost because it is based on us having to build everything from scratch. We already have a pilot road that covers half the distance where historic placer mines were operated. So the first 160-180 km have already been piloted allowing us to plan for the construction of a pilot road the remaining distance to the site. This would allow for us to deliver all the necessary materials, supplies and heavy equipment – especially the construction materials to the site itself.

– When will the DFS be done?

– There are several studies that need to be compiled. The primary one is the bankable feasibility study which is two years out, so we are looking around the early to mid 2017 where we will have the bankable feasibility study completed. A lot of the pre-feasibility study work has been done to this point and we have different parts of the engineering under review. As the results are obtained, we will announce these through the RNS process established by the London Stock Exchange.

These will become an integral part of the bankable feasibility study. Presently, we consider the available work that has been completed to be at a pre-feasibility level because we don’t know exactly what the long term pricing and long term metallurgical recoveries will be. Another consideration available to us is based on a recent drilling results that should increase our resource estimates as well as undertaking a more rigorous underground production component that could we result in production of higher grades than what we anticipated in the models. We have noted that previously and look forward to the development of a full production plan that optimised metal recovery.

– Thank you very much.

– You’re welcome

Download Forum Brochure

Download Forum Brochure

Download Events Flyer

Download Events Flyer